Mortgage interest costs change over time, affecting your monthly payments and how they’re split between principal and interest. Early in your loan, a larger portion of each payment goes toward interest, especially if rates are high. As you pay down the principal, the interest portion decreases. Fluctuating rates can also impact variable-rate loans, potentially leading to higher or lower payments. If you’re curious about how these changes work in detail, there’s more to uncover below.

Key Takeaways

- Mortgage interest is calculated based on the remaining loan balance, decreasing over time as you make payments.

- Early in the loan, a larger portion of each payment goes toward interest, with principal repayment increasing later.

- Fluctuating interest rates affect adjustable-rate mortgages, causing payments to rise or fall over the loan term.

- Locking in fixed rates can protect against rising interest costs, while falling rates may enable refinancing for savings.

- Understanding interest trends helps in planning payments, refinancing, and managing overall loan costs effectively.

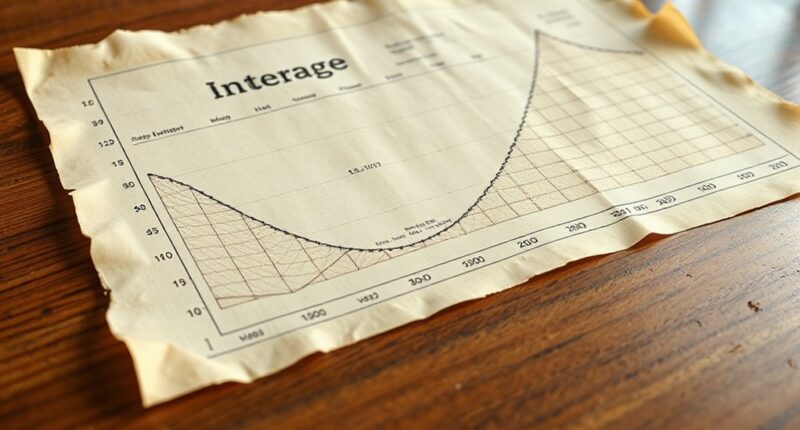

Understanding how mortgage interest rates have changed over time helps you make smarter borrowing decisions. When you take out a mortgage, your monthly payments are divided between paying down the principal and covering the interest costs. The way these payments are structured is outlined in an amortization schedule, which shows how much of each payment goes toward interest and how much reduces your loan balance over time. Watching how the interest rate trends fluctuate allows you to anticipate how your payments might change if you’re considering refinancing or switching loans. Interest rate fluctuations can significantly impact your overall costs and payment strategies.

Interest rates don’t stay the same; they fluctuate based on economic conditions, monetary policy, and market forces. Historically, there have been periods of low interest rates, which make borrowing cheaper, and times of higher rates, which increase your overall costs. By understanding these patterns, you can better time your mortgage application or decide whether to lock in a rate. For example, if interest rate trends indicate a potential rise, locking in a fixed rate could save you money in the long run. Conversely, if rates are expected to drop, you might opt for a variable-rate mortgage or wait before locking in a rate.

Your amortization schedule plays a vital role in understanding how these interest rate changes affect your payments over time. Early in your loan, a larger portion of each payment goes toward interest, especially when rates are high. As you continue paying down the principal, the interest portion decreases, and more of your payment reduces the loan balance. If interest rates rise, your future payments could be affected if you have an adjustable-rate mortgage, potentially increasing your monthly costs. Conversely, if rates drop, you might benefit from lower payments or the ability to refinance at a more favorable rate.

Monitoring interest rate trends can also influence your decision on how long to keep your mortgage. For instance, if rates are trending downward, you might consider refinancing to secure a lower rate and reduce your total interest paid over the life of the loan. On the other hand, if rates are expected to rise, locking in a fixed rate sooner could protect you from future increases.

Frequently Asked Questions

How Does Refinancing Affect Mortgage Interest Over Time?

Refinancing your mortgage resets your loan amortization schedule and can reduce your interest costs by securing a lower rate. It affects interest compounding because a new loan balance starts fresh, potentially decreasing total interest paid over time. However, refinancing may extend your loan term, which could increase interest paid in the long run. Carefully compare your current rate, remaining term, and new terms to see if refinancing benefits you financially.

What Is the Impact of Making Extra Payments on Interest?

Imagine slicing through a thick fog of interest—by making extra payments, you clear that fog faster. Your additional payments directly reduce the principal, cutting down on interest compounding over time. This can save you money and shorten your loan term, but beware of prepayment penalties that might apply. You take control, brightening your financial future by making smart, early moves to diminish the interest burden.

How Do Adjustable-Rate Mortgages Influence Long-Term Interest Costs?

Adjustable-rate mortgages influence your long-term interest costs through variable rates and payment adjustments. When rates rise, your interest payments increase, potentially raising your monthly costs. Conversely, if rates fall, your payments decrease, saving you money. Over time, these fluctuations can make your total interest paid unpredictable. This variability can benefit you during periods of declining rates but poses risks if rates climb markedly.

Does Paying off a Mortgage Early Save on Interest?

Imagine your mortgage as a river steadily flowing toward the sea of debt. Paying it off early cuts through the current, reducing interest accrual and shortening loan amortization. Each extra payment acts like a dam, slowing interest buildup and helping you reach financial freedom sooner. Yes, paying early saves you money on interest because you decrease the time interest accrues, making your journey to debt-free smoother and quicker.

How Do Changes in Interest Rates Affect Existing Fixed-Rate Mortgages?

Interest rate fluctuations don’t affect your fixed-rate mortgage because your rate stays the same throughout the loan term. However, if you have an adjustable-rate mortgage, changes in interest rates can impact your payments. During mortgage amortization, your payments are split between interest and principal. When rates rise, more of your payment goes toward interest, slowing down equity buildup; if rates fall, you pay less interest over time.

Conclusion

Understanding how mortgage interest works over time can feel overwhelming, but it’s empowering to know how your payments shift. At first, your payments mainly cover interest, making it seem like you’re not chipping away at the principal. Yet, as time goes on, more of your money goes toward reducing the loan balance. This contrast between initial costs and long-term savings highlights the importance of smart planning—so you can turn your mortgage into a stepping stone, not a burden.