The 50-30-20 budget rule helps you manage your income by splitting it into three categories: needs, wants, and savings or debt repayment. You allocate 50% of your after-tax income to essentials like rent, groceries, and utilities. About 30% goes to non-essential items such as entertainment and dining out, while 20% is set aside for savings or paying off debts. Following this simple guideline keeps your finances balanced, and exploring further can assist you in customizing your budget to fit your goals.

Key Takeaways

- The 50-30-20 rule divides after-tax income into needs (50%), wants (30%), and savings/debt (20%).

- Needs include essentials like housing, utilities, groceries, and transportation, ensuring basic needs are met.

- Wants cover non-essential expenses such as dining out, entertainment, and travel, promoting balanced spending.

- Savings and debt repayment focus on building emergency funds, paying off debt, and supporting long-term financial goals.

- This rule simplifies budgeting, encourages regular review, and helps maintain financial balance and security.

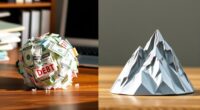

If you’re looking for a simple way to manage your finances, the 50-30-20 budget rule offers a straightforward framework. It divides your after-tax income into three clear categories: needs, wants, and savings or debt repayment. This approach makes it easier to see where your money goes, helping you establish effective savings strategies and stay on top of debt management. By allocating your income in this way, you create a balanced financial plan that promotes stability and growth.

The 50-30-20 rule simplifies budgeting by dividing income into needs, wants, and savings for better financial control.

The largest portion, 50%, is reserved for needs. These include essentials like rent or mortgage payments, utilities, groceries, insurance, and transportation costs. Keeping these expenses within this limit ensures you meet your basic requirements without overspending. It encourages you to prioritize necessities, making it easier to identify areas where you might cut back if your expenses start to exceed your income. This focus on needs also helps prevent impulsive spending on non-essential items, fostering disciplined financial habits.

Next, 30% is designated for wants. This category covers non-essentials such as dining out, entertainment, shopping, and vacations. While it’s important to enjoy your money, sticking to this limit helps you avoid the trap of overspending on luxuries that can derail your financial goals. When you consciously manage your wants, you free up resources for more meaningful purposes, like boosting your savings or paying down debt. This balance ensures you enjoy your lifestyle without compromising your financial security.

The remaining 20% goes toward savings and debt management. This portion is vital because it directly impacts your financial future. Whether you’re building an emergency fund, saving for a big purchase, or paying off credit card debt, this category supports your goals. Developing consistent savings strategies not only helps you weather unforeseen expenses but also accelerates your journey toward financial independence. If you’re carrying debt, directing part of your income here can help you reduce it more efficiently, lowering interest costs and improving your credit score over time.

Sticking to the 50-30-20 rule simplifies budgeting by providing clear boundaries and priorities. It encourages you to regularly review your spending habits, identify areas for improvement, and stay committed to your financial goals. Over time, this structure can help you develop healthier money habits, reduce financial stress, and achieve greater financial security. Remember, the key is consistency—adjust the percentages slightly if needed, but keep the core principles in mind to balance your immediate needs with long-term financial health.

Frequently Asked Questions

Can the 50-30-20 Rule Work for High-Income Earners?

Absolutely, the 50-30-20 rule can work for high-income earners, but you might want to modify it. You could allocate more to luxury spending without compromising savings, and diversify your investment strategies for greater growth. The key is maintaining balance; high earners often have more room to indulge while still building wealth. Customizing your budget ensures you meet your financial goals while enjoying the lifestyle you desire.

How Flexible Is the 50-30-20 Rule During Financial Emergencies?

Flexibility fluctuates during financial emergencies, so you can swiftly shift spending strategies. When urgent needs arise, consider emergency adjustments by temporarily trimming discretionary expenses and prioritizing essentials. Flexibility tips include reallocating funds, delaying non-essential payments, and revising your budget plan to suit sudden circumstances. You’ve got the power to adapt, ensuring your financial foundation stays firm even when unexpected events unexpectedly disrupt your usual financial flow.

Is the 50-30-20 Rule Suitable for Self-Employed Individuals?

The 50-30-20 rule can work for self-employed individuals, but you need to take into account tax implications and adjust your allocations. Since your income may vary, you might allocate more to savings or investments strategies during higher earnings and reduce spending during lean months. Flexibility is key; make sure you set aside enough for taxes and adapt your budget to your fluctuating income, maintaining financial stability.

How Should I Adjust the Rule for Variable Monthly Income?

You should adjust your spending to account for income fluctuations by creating a flexible budget that prioritizes savings during high-income months. Allocate a portion of extra income to savings or debt repayment, so you’re prepared for leaner periods. During lower-income months, cut back on non-essentials and dip into your savings if needed. Regularly reviewing and adjusting your savings plan helps you stay balanced despite income variability.

What Are Common Mistakes When Applying This Budget Rule?

Did you know nearly 60% of people make budget missteps? When applying this rule, common spending pitfalls include overestimating income, failing to track expenses, and neglecting savings. You might also cut too much from essentials or overspend on wants, leading to financial stress. To avoid these mistakes, stay realistic, monitor your spending regularly, and adjust your categories as your income fluctuates. This keeps your budget balanced and achievable.

Conclusion

By following the 50-30-20 rule, you can effectively manage your finances and avoid debt. Did you know that only about 41% of Americans have a budget? Sticking to this simple guideline helps you prioritize essentials, enjoy some extras, and save for the future. It’s a straightforward way to gain control over your money, reduce stress, and work toward your financial goals with confidence. Start today and see how small changes make a big difference.