Choosing between the debt snowball and debt avalanche depends on what motivates you most. If you want quick wins to boost confidence and stay motivated, the snowball method—paying off small debts first—could work best. If you’re goal-oriented and want to save money on interest, the avalanche method—targeting high-interest debts—may suit you. Understanding your emotional drive helps you pick the right approach, and keeping these factors in mind can lead to better results as you continue.

Key Takeaways

- Choose the snowball method if you need quick wins to stay motivated.

- Opt for the avalanche if you prioritize saving money through interest reduction.

- Consider your emotional response: if delayed progress demotivates, snowball may be better.

- If you are goal-oriented and strategic, avalanche aligns with long-term financial efficiency.

- Tailor your choice to your motivation style to enhance commitment and increase debt payoff success.

Are you overwhelmed by debt and unsure which strategy will help you pay it off faster? When debt feels like a heavy weight on your shoulders, it’s easy to feel discouraged or even hopeless. That’s where understanding your emotional motivation and debt psychology becomes essential. Your mindset and emotional responses to debt influence how you approach repayment. Some people thrive on quick wins that boost confidence, while others prefer methodical, long-term plans. Recognizing what motivates you can help you choose between the debt snowball and avalanche methods more effectively.

Understanding your emotional motivation is key to choosing the best debt repayment strategy.

The debt snowball strategy centers on paying off your smallest debts first, regardless of interest rates. This approach taps into emotional motivation by giving you quick, tangible victories. As you pay off each small debt, you experience a sense of progress that can bolster your confidence and reduce anxiety. It’s a psychological boost that keeps you motivated to tackle larger debts down the line. From a debt psychology perspective, this method leverages the power of positive reinforcement—each paid-off debt feels like a personal achievement, reinforcing your commitment to becoming debt-free. This emotional momentum often outweighs the mathematical advantage of saving on interest, especially if you need encouragement to stay on track. Additionally, using compact and user-friendly tools like portable camping gear can make the process feel less burdensome, just as choosing the right camping equipment simplifies outdoor adventures.

On the other hand, the debt avalanche approach focuses on paying off debts with the highest interest rates first. This method appeals to your logical side, saving you more money in the long run by reducing the amount of interest paid over time. However, it might take longer to experience the satisfaction of a debt being paid off, which can be challenging for your emotional motivation. If you’re someone who needs visible progress to stay engaged, this strategy might feel less rewarding initially. Yet, for those driven by financial efficiency and a desire to minimize total interest paid, the avalanche method aligns with a strategic mindset rooted in debt psychology—focusing on the most cost-effective way to eliminate debt.

Ultimately, your choice depends on how you respond emotionally to debt repayment. If quick wins motivate you and help you stay engaged, the snowball method may suit you best. If your priority is minimizing interest and you’re comfortable with delayed gratification, the avalanche approach might be more effective. Understanding your debt psychology and emotional motivations ensures that whichever method you choose, you stay committed and motivated throughout your journey to debt freedom.

Frequently Asked Questions

Can I Combine Both Debt Repayment Methods Effectively?

Yes, you can combine both debt repayment methods effectively. Start by prioritizing debts with the highest interest rates to save money, following the avalanche approach. Then, once those are paid off, switch to the snowball method by focusing on smaller debts to build momentum. This hybrid strategy balances debt prioritization and repayment consistency, helping you stay motivated while reducing overall interest costs efficiently.

Which Method Is Better for Improving Credit Scores?

Imagine your credit score as a delicate garden; nurturing it requires strategic tools. The debt snowball method can boost your credit by building momentum through quick wins, while the avalanche method lowers overall debt faster, reducing interest costs. Incorporate credit counseling and debt consolidation to strengthen your financial foundation. Choose the approach that aligns with your goals—either way, consistent effort will help your credit blossom.

How Does Income Fluctuation Affect These Strategies?

Income fluctuations can impact your debt repayment strategies by making income stability unpredictable. When your income varies, you might need to adjust your financial planning, perhaps slowing down payments or focusing on emergency savings first. Both debt snowball and avalanche methods require flexibility, but maintaining a steady plan helps you stay on track. Prioritize creating a buffer for income fluctuations to guarantee consistent progress toward debt freedom.

Are There Specific Debts Better Suited for One Method?

You’ll find that smaller debts are better suited for the debt snowball method, boosting your motivation through quick wins and positive reinforcement. Larger, high-interest debts often benefit from the avalanche method, saving you money over time. Your debt prioritization and payment psychology play key roles; choose based on what keeps you motivated and focused. If quick progress motivates you, snowball works best, but if saving interest is your goal, go for avalanche.

What Psychological Factors Influence Success With Each Method?

Ever wonder what keeps you motivated to pay off debt? Psychological motivation plays a big role, influenced by behavioral finance principles. If you crave quick wins, the debt snowball method boosts your confidence, making it easier to stay committed. Alternatively, if you’re driven by saving more interest, the avalanche appeals to your rational side. Your mindset and emotional rewards shape your success, so choose the method that aligns with what motivates you most.

Conclusion

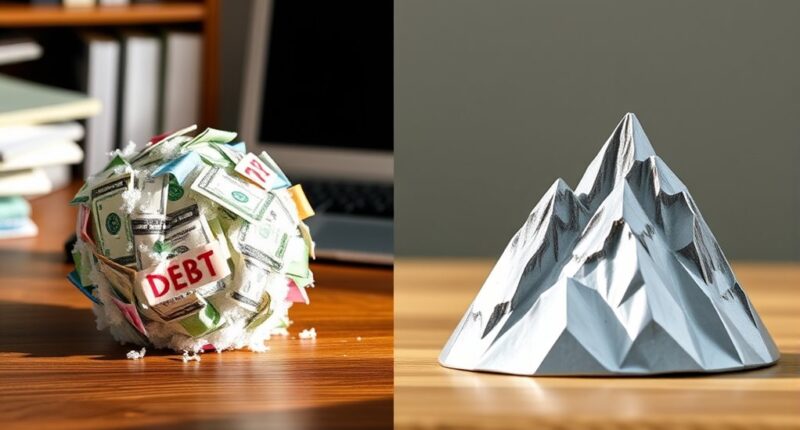

Choosing between the debt snowball and avalanche is like picking your path through a dense forest. The snowball rolls with small wins, symbolizing hope and momentum, while the avalanche charges ahead with calculated precision, representing control and efficiency. Whichever path you choose, remember you’re forging your own trail toward financial freedom. Trust your instincts, stay committed, and let your chosen method be the compass guiding you out of debt’s shadows into the sunlight of stability.