If you’re relying heavily on credit, missing payments, or living paycheck to paycheck, these are clear red flags that you’re one financial emergency away from trouble. Accumulating debt, lack of an emergency fund, or constantly borrowing indicate your finances are unsteady. Ignoring these signs can lead to defaults, fees, or sinking deeper into debt. Keep an eye out for these warning signs to protect your future—continue exploring to learn how to address them effectively.

Key Takeaways

- Consistently late payments and rising debt indicate financial instability and increased risk of emergencies.

- Overreliance on credit or payday loans signals a fragile financial cushion.

- Lack of an emergency fund leaves you vulnerable to unexpected expenses.

- Ignoring or avoiding reviewing financial statements can mask underlying issues.

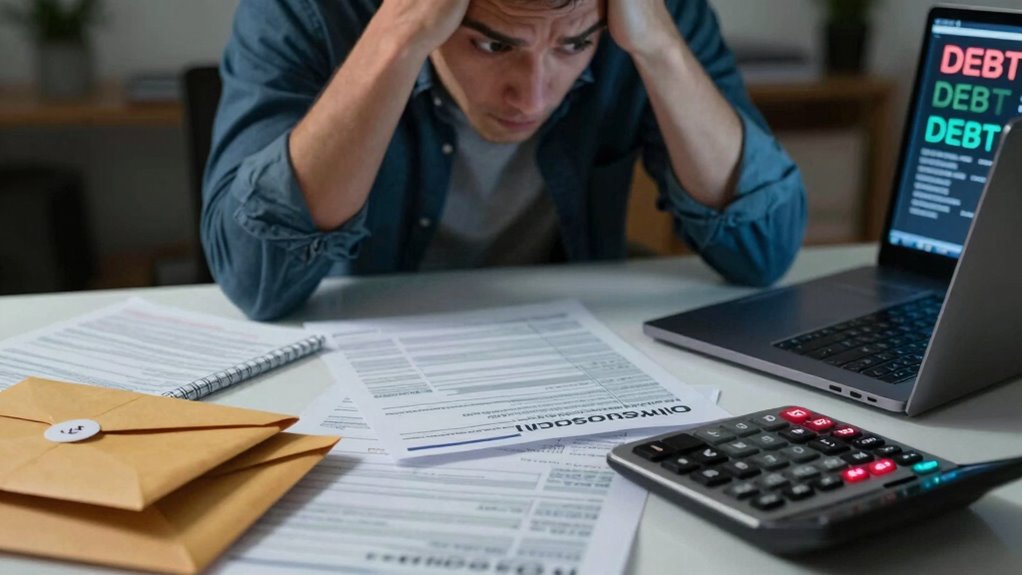

- Struggling to manage debt or feeling overwhelmed suggests you’re nearing a financial crisis.

How to Spot Unmanageable Debt and Overuse of Credit

Recognizing unmanageable debt and excessive credit use is essential to maintaining your financial health. Pay attention to your credit cycles—if your debt consistently peaks at certain times or feels overwhelming, it’s a red flag. Debt stacking, where you rely on new credit to pay off existing debts, signals trouble. This pattern can trap you in a cycle of borrowing that’s hard to break. If you notice yourself juggling multiple credit accounts or continually increasing your balances, it’s time to reassess. Overuse of credit often leads to higher interest payments and mounting stress. Monitoring your credit utilization rate helps identify when debt levels are becoming unsustainable. Being aware of these signs helps you catch issues early. Staying proactive about your credit habits ensures you don’t fall into a pattern that could jeopardize your financial stability.

Signs You’re Missing Payments and What to Do About It

If you notice your payments are late, it’s a clear sign something’s off. Ignoring these missed payments can lead to defaults and damage your credit score. Take action quickly by tracking your payments and addressing any issues before they escalate. Being aware of your financial health can help you identify early warning signs and prevent further complications. Additionally, understanding tax implications related to missed payments or financial missteps can be crucial for maintaining stability. Monitoring your affiliate disclosures ensures transparency in financial transactions and can help you make more informed decisions.

Late Payments Signal Trouble

Have you noticed your payments are consistently late? This could be a sign of deeper financial trouble, especially if you’re engaging in credit card misuse or experiencing income inconsistencies. Late payments may happen because your bills are piling up or your income isn’t enough to cover your expenses on time. Ignoring these signs can lead to more serious issues like increased interest rates, fees, and damage to your credit score. If you’re missing payments regularly, it’s a red flag that your finances are stretched thin. Addressing the root cause—whether it’s adjusting your budget or seeking additional income—can help you get back on track. Don’t overlook late payments; they’re a clear signal that you need to take action before more severe problems develop.

Track and Address Defaults

Noticing missed payments is a crucial step in managing your finances effectively. When you track your defaults, you stay aware of any overdue accounts that could harm your credit management efforts. Timely identification allows you to address issues before they escalate, such as missed payments affecting your credit score. If defaults start piling up, consider debt consolidation to simplify payments and reduce interest rates. This strategy can help you regain control and prevent further defaults. Staying proactive by reviewing your payment history regularly ensures you catch problems early. Address defaults promptly by contacting lenders or negotiating new repayment plans. Being aware of wave and wind patterns can also help you predict and avoid financial storms that might impact your income or expenses. Recognizing support systems can provide additional assistance and guidance during financial challenges. Taking these steps keeps your finances on track and minimizes the long-term damage that missed payments can cause.

Are You Struggling to Cover Basic Expenses Every Month?

Struggling to cover basic expenses each month can be a clear sign that your finances are stretched too thin. If you find yourself constantly dipping into savings or relying on credit to make ends meet, it’s time to examine your spending habits. Overspending on non-essentials or failing to track where your money goes can worsen the situation. Consider seeking credit counseling to develop a realistic budget and gain control over your finances. Addressing these issues early helps prevent debt spirals and financial emergencies. Recognizing that your income isn’t enough to meet your basic needs is vital. By understanding your spending patterns and seeking guidance, you can start making smarter choices and work toward financial stability. Additionally, reviewing your budgeting methods can help identify areas to cut back and improve your financial health. Implementing diversification strategies for your savings can also protect your financial future from unforeseen setbacks. Being aware of financial red flags can alert you to potential crises before they develop into emergencies. Moreover, staying informed about European cloud solutions and their impact on financial planning can offer new perspectives on managing resources effectively.

Relying on Future Income or Windfalls: Is Your Budget at Risk?

Relying on future income or unexpected windfalls to cover current expenses can put your budget at serious risk. This approach undermines solid emergency planning and creates uncertainty. If your income forecasts are overly optimistic or unpredictable, you might find yourself unable to meet urgent needs when those anticipated funds don’t materialize. Relying on future income can lead to a cycle of borrowing or delaying essential expenses. It’s vital to base your budget on realistic income assessments and avoid depending on unpredictable sources. Instead, focus on building a stable financial foundation that doesn’t hinge on uncertain events. Proper emergency planning means preparing for the unexpected with reliable resources rather than hoping for windfalls or future earnings to save the day.

Why Living Without an Emergency Fund Is Dangerous: and How to Start Building One

Living without an emergency fund leaves you vulnerable to unexpected expenses that can quickly derail your finances. Starting to save might seem challenging, but even small steps can build your resilience over time. Taking control now helps you avoid unnecessary stress and keeps your financial future secure. Understanding the small systems behind everyday financial decisions can help you identify opportunities to save and protect yourself from larger setbacks. Recognizing how financial habits develop can empower you to make smarter choices and establish a safety net before crises occur.

Risks of No Savings

Without an emergency fund, unexpected expenses can quickly derail your financial stability. Imagine facing a sudden medical bill, car repair, or job loss without savings to fall back on. This can lead to:

- Accumulating high-interest debt, making credit counseling or debt consolidation necessary.

- Losing your ability to cover basic living expenses, like rent or groceries.

- Damaging your credit score due to missed payments.

- Feeling overwhelmed and stressed, which impacts your overall financial health.

Without savings, you’re more vulnerable to financial crises that can push you further into trouble. Having an emergency fund acts as a safety net, helping you handle surprises without resorting to costly debt solutions. It’s a vital step to secure your financial future.

Steps to Start Saving

Starting to build an emergency fund may seem intimidating, but taking small, deliberate steps can make the process manageable. Begin by setting a realistic savings goal—aim for at least three to six months of expenses. Automate regular contributions, even if they’re modest, to create consistent growth. While saving, consider exploring different investment strategies to maximize your funds’ potential, but prioritize safety and liquidity. If you feel overwhelmed or uncertain about managing your finances, credit counseling can provide valuable guidance and help you create a tailored plan. Remember, the key is to start now, stay disciplined, and gradually build your cushion. simple systems can make managing your savings more straightforward and less overwhelming. Using sizing and load‑planning tools from trusted resources can help you better understand what you need to save for your specific circumstances, making your goal more attainable. Additionally, understanding your financial redundancy can help you identify potential vulnerabilities and focus your savings effectively. Over time, these simple actions will help protect you from financial emergencies and reduce stress when unexpected expenses arise.

Building Emergency Resilience

Having an emergency fund is essential because it provides a financial safety net during unexpected events like job loss, medical emergencies, or urgent repairs. To build emergency resilience, focus on these steps: 1. Set aside 3-6 months’ worth of living expenses in a dedicated account. 2. Use smart investment strategies to grow your savings with minimal risk. 3. Keep your emergency fund separate from your regular investments for quick access. 4. Incorporate tax planning to maximize savings and reduce liabilities. Regularly reviewing your body jewelry measurements and materials can also prevent costly replacements and ensure comfort during unforeseen circumstances.

Are You Constantly Borrowing or Using Payday Loans? Here’s Why It Matters

If you find yourself constantly borrowing or relying on payday loans, it’s a clear sign that your financial situation might be more fragile than you realize. Relying on short-term fixes often indicates you’re struggling to cover basic expenses, which can lead to a cycle of debt. Using credit cards irresponsibly or taking out payday loans without understanding the true cost can compound your problems. Improving your financial literacy is essential—it helps you recognize healthier alternatives and avoid debt traps. Additionally, understanding how to manage electric bikes and their costs can motivate smarter financial decisions around transportation expenses. Recognizing these red flags now can prevent further financial trouble down the road and help you create a more stable financial future. Being aware of affiliate disclosures and privacy policies can also help you make informed decisions about online financial resources and tools. Consider exploring options like diversification strategies for investments to build a more resilient financial plan.

Late Payments and Fees: How They Hurt Your Finances and How to Fix It

Constantly missing payments or racking up late fees can further destabilize your finances and make it harder to regain control. Late payments damage your credit score, increase debt with penalties, and limit your borrowing options. To fix this, consider:

Consistently missing payments harms your credit, increases debt, and limits borrowing—act now with automatic payments or credit help.

- Setting up automatic payments to avoid missing due dates

- Contacting your creditors for payment extensions or arrangements

- Seeking credit counseling for personalized debt management strategies

- Exploring debt consolidation to combine multiple debts into one manageable payment

Curiosity can also motivate you to stay organized and proactive about your financial health.

Digging Into Savings or Retirement Funds? What It Means for Your Future

Using your savings or retirement funds for quick cash can seem tempting, but it often comes with risks. It may solve a short-term problem, yet it can jeopardize your long-term financial security. Consider how this choice impacts your future retirement goals before pulling from those critical resources. For example, visiting a restaurant with live music or celebrating a special occasion might be more enjoyable when your finances are in order, rather than risking future stability. Financial red flags can often be identified early by recognizing these risky behaviors and planning accordingly. Small financial habits can have a cumulative effect on your overall security, so staying vigilant is key. Recognizing early warning signs like negative net worth can help you avoid deeper financial trouble down the line. Being aware of spending patterns can also help you make smarter financial decisions that protect your future, especially when you understand financial literacy and how it influences your financial choices.

Risks of Short-Term Use

Digging into your savings or retirement funds for short-term expenses might seem like a quick fix, but it can jeopardize your financial future. Relying on this money can lead to increased credit card abuse, as unpaid balances grow. Additionally, taking out payday loans introduces high-interest risks that trap you in a cycle of debt. Here are the dangers:

- Eroding your long-term savings, reducing future security

- Increasing financial stress due to depleted emergency funds

- Triggering fees and penalties from missed payments or early withdrawals

- Making you more vulnerable to credit card abuse and payday loan risks

Short-term solutions might seem necessary now, but they often come with costly consequences that hinder your financial stability down the line.

Impact on Retirement Goals

When you tap into your savings or retirement funds for immediate expenses, you’re making a choice that can substantially set back your long-term financial security. It exposes you to investment pitfalls, as early withdrawals often reduce the compounding potential of your investments. Furthermore, resorting to retirement funds can lead to credit mismanagement, especially if you rely on borrowing or credit cards to cover emergencies. This behavior creates a cycle of financial instability, making it harder to reach your retirement goals. Over time, the missed growth and increased debt can leave you unprepared for the future. Understanding these impacts encourages better planning and discipline, helping you avoid behaviors that threaten your financial independence and peace of mind in later years.

Avoiding Financial Goals or Skipping Budgeting? Here’s Why It’s a Warning Sign

Ignoring your financial goals or skipping budgeting may seem harmless at first, but it often signals deeper issues. When you avoid setting goals or neglect budgeting, you might fall into budgeting pitfalls that lead to financial complacency. Here’s what this behavior indicates:

Neglecting budgeting signals deeper financial issues and risks leading to overspending and insecurity.

- You’re drifting without clear priorities, risking overspending.

- You’re unaware of your true financial standing, making emergencies more likely.

- You’re delaying important milestones, like saving for a home or retirement.

- You’re cultivating a false sense of security, which can turn into financial trouble.

- This pattern often reflects a lack of financial literacy, making it harder to make informed decisions.

Feeling Overwhelmed by Money? When and How to Seek Financial Help

If avoiding budgeting and financial goals has left you feeling lost or stressed about your money, it’s a sign you might need support. Feeling overwhelmed by money can hinder your ability to make smart decisions, but seeking financial help can change that. Start by improving your financial literacy—understand basic concepts like debt management and saving strategies. Consider professional advice from a financial planner or credit counselor who can guide you through budget planning tailored to your situation. Don’t hesitate to ask for help when your financial stress becomes unmanageable. Recognizing the need for support is a sign of strength, not weakness. Taking these steps can empower you to regain control and build a more stable financial future.

Frequently Asked Questions

How Can I Identify Hidden Financial Vulnerabilities?

You can identify hidden financial vulnerabilities by regularly reviewing your credit score and debt management strategies. If your credit score dips unexpectedly, it signals potential issues. Also, check for hidden debts or missed payments that could undermine your financial stability. Stay vigilant about your spending habits, and make certain your debt management plan is up-to-date. These steps help you catch vulnerabilities early before they escalate into emergencies.

What Are Early Signs of Impending Financial Crisis?

You might notice your credit score dropping unexpectedly or increasing debt accumulation without clear reasons. Late payments or maxed-out credit cards are warning signs, and if your expenses outpace income regularly, you’re heading toward trouble. Keep an eye on these indicators, and address them early by creating a budget, reducing unnecessary spending, and seeking financial advice to prevent a full-blown crisis.

How Does Emotional Spending Impact Financial Health?

Emotional spending impacts your financial health by often bypassing your impulse control, leading you to make unplanned purchases driven by emotional triggers like stress or boredom. When you give in to these impulses, you may deplete your savings and increase debt, making it harder to achieve financial stability. Recognizing emotional triggers helps you pause and evaluate purchases, strengthening your impulse control and keeping your finances on track.

When Should I Consult a Financial Advisor?

When your finances feel like a ticking time bomb, it’s time to consult a financial advisor. They can help you avoid investment pitfalls and refine your savings strategies. If you’re unsure about managing debt, planning for retirement, or balancing risk, don’t wait for things to blow up. A pro offers expert guidance, helping you stay on track and secure your financial future before trouble hits the fan.

What Are Common Mistakes That Worsen Financial Instability?

You worsen financial instability by making credit mismanagement and overspending habits. If you ignore paying bills on time or max out credit cards, you damage your credit score and increase debt. Overspending on non-essentials drains your funds, leaving little for emergencies. To improve your situation, cut unnecessary expenses, stick to a budget, and pay bills promptly. Avoiding these mistakes helps you regain control and build a more secure financial future.

Conclusion

If your finances feel like a sinking ship, it’s time to toss out the warning flags. Ignoring these signs can leave you stranded in stormy waters, with no lifeboat in sight. But by recognizing the red flags—missed payments, mounting debt, no emergency fund—you can steer back to calmer seas. Take control now, chart a clear course, and let your financial ship sail smoothly toward brighter horizons.