The yield curve shows the relationship between interest rates and maturity dates for bonds, signaling market expectations. An upward sloping curve suggests steady growth, while an inverted one warns of possible recession. A flat curve indicates uncertainty. Keep in mind, external factors like monetary policy or market sentiment can distort signals. If you want to understand what the shape truly means and how to avoid misinterpretations, there’s more to explore below.

Key Takeaways

- The yield curve shows the relationship between interest rates and bond maturities, indicating market expectations.

- An upward-sloping (normal) curve suggests economic growth, while an inverted curve may signal recession risks.

- Flattening or inverted curves often reflect investor concerns about slowing growth or potential downturns.

- External factors like central bank policies and market sentiment can distort the curve’s signals.

- Use the yield curve alongside other economic indicators for a balanced understanding of economic conditions.

What Is the Yield Curve and Why Is It Important for Investors?

The yield curve is a graph that shows the relationship between interest rates (or yields) and the time to maturity for debt securities like government bonds. It’s essential for understanding bond pricing, as longer-term bonds generally have higher yields to compensate for increased risks. As an investor, you should know that the shape of the yield curve reflects market expectations and influences your investment decisions. It also highlights interest rate risks; when rates fluctuate, bond prices move inversely. A rising yield curve suggests growth expectations, while a flat or declining curve may signal economic uncertainty. By analyzing the yield curve, you gain insights into potential risks and opportunities, helping you manage your portfolio more effectively amid changing interest rate environments. Additionally, understanding the role of the yield curve in monetary policy can provide deeper insights into economic trends and central bank actions. Recognizing market expectations based on the yield curve can help you make more informed investment choices and avoid potential pitfalls. Moreover, the shape of the yield curve can influence investment strategies by indicating the optimal timing for bond purchases or sales.

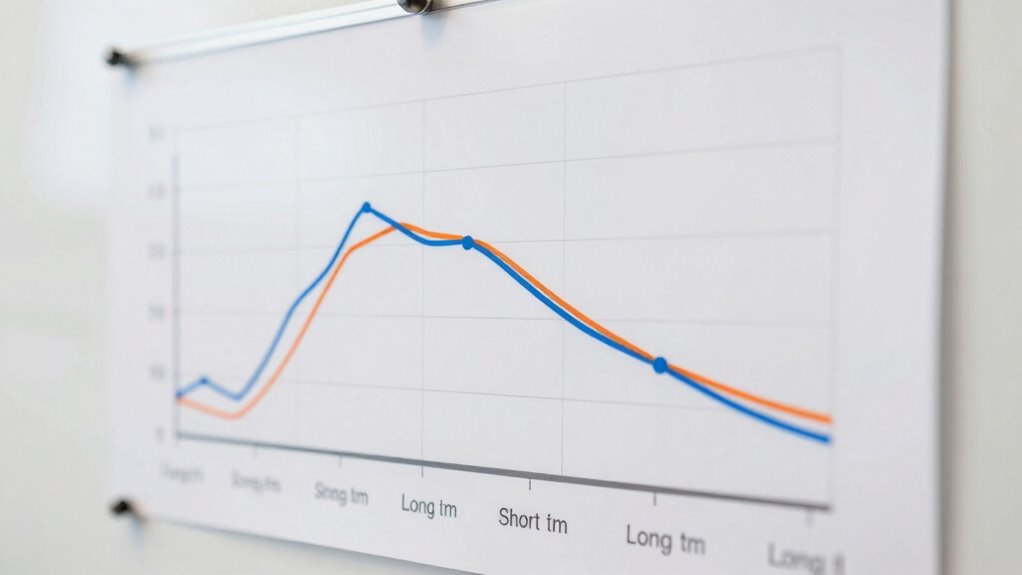

What Are the Main Types of Yield Curves? (Normal, Inverted, Flat)

Understanding the main types of yield curves helps you interpret market signals and make informed investment decisions. A normal yield curve slopes upward, indicating longer-term bonds have higher yields than short-term ones, reflecting stable economic growth. An inverted yield curve slopes downward, where short-term yields exceed long-term yields, often signaling recession risks and narrowing bond spreads. A flat curve appears when short- and long-term yields are similar, suggesting economic uncertainty or shift. Recognizing these shapes allows you to gauge market sentiment and potential recession signals. For example, persistent inversion might warn of upcoming downturns, while a steepening normal curve suggests growth. Monitoring these types helps you adjust your strategies based on market expectations without falling prey to hype. Sizing and load‑planning tools from reliable sources can assist in understanding economic signals and planning accordingly.

How Does the Shape of the Yield Curve Reflect Market Expectations?

The shape of the yield curve can reveal what investors expect about future economic growth and inflation. When the curve steepens, it often signals optimism about growth, while an inverted curve suggests concerns about a slowdown. Market expectations also shift as central banks change policies, influencing long-term interest rates accordingly. Additionally, understanding Free Floating concepts helps interpret how interest rates can fluctuate independently of fixed benchmarks.

Economic Growth Indicators

Since investors’ expectations about future economic growth influence bond yields, the shape of the yield curve serves as a key indicator of market sentiment. When the curve is steep, it suggests optimism about growth, prompting expectations of higher future interest rates. Conversely, a flat or inverted curve signals concerns about slowing growth or a potential recession. Here’s how it reflects economic outlooks: 1. A steepening curve often indicates confidence in robust economic expansion and positive investor sentiment. 2. An inverted curve may signal fears of an upcoming slowdown, prompting caution and possibly a shift in monetary policy. 3. Market participants interpret changes in the curve’s shape as signals about future growth prospects, influencing investment decisions and monetary policy adjustments. Monitoring the yield curve’s shape helps investors and policymakers gauge economic health and potential risks. Additionally, understanding the market expectations embedded in the curve can assist investors in making informed decisions aligned with economic forecasts, as market sentiment heavily influences financial markets and economic trajectories. Recognizing how the interest rate environment impacts the curve can also provide deeper insights into potential policy changes and economic shifts.

Inflation Expectations Shift

Changes in the shape of the yield curve often reveal how investors are adjusting their expectations for future inflation. When long-term yields rise faster than short-term yields, it indicates rising inflation expectations, suggesting market sentiment anticipates higher prices later. Conversely, a flattening or inverted curve signals that investors expect lower inflation or even deflation, reflecting caution. Use the table below to understand how different yield curve shapes relate to inflation expectations:

| Shape of Yield Curve | Market Expectation of Inflation |

|---|---|

| Steep | Rising inflation expectations |

| Normal | Stable inflation expectations |

| Flat | Uncertain inflation outlook |

| Inverted | Falling inflation expectations |

| Humped | Transition phase, mixed signals |

This shift in expectations influences your investment strategies and how you interpret market sentiment.

Monetary Policy Signals

The shape of the yield curve provides valuable signals about monetary policy expectations. When the curve steepens, it suggests bond markets expect interest rate hikes to curb inflation. Conversely, an inverted curve indicates market anticipation of interest rate cuts due to economic slowdown. Here are three key insights: 1. A steepening curve signals traders expect rising interest rate trends, often reflecting tighter monetary policy. 2. A flattening or inverted curve hints at market expectations of easing or cuts, possibly signaling recession risks. 3. These shifts influence bond markets, affecting yields across different maturities and guiding investors on future monetary policy moves. Additionally, understanding air quality considerations can help investors gauge economic health and environmental impacts that may influence market sentiment. Recognizing market sentiment indicators can further enhance the interpretation of yield curve signals in relation to broader economic conditions. Monitoring interest rate expectations can also provide insight into how central banks may adjust their policies in response to evolving economic data. Moreover, financial stability concerns may also impact the yield curve’s shape, reflecting risks to economic resilience. Furthermore, changes in the yield curve can be indicative of underlying inflation expectations, which are critical for predicting future monetary policy adjustments.

What Are Common Misconceptions and Limitations of the Yield Curve?

Many investors assume the yield curve always predicts economic downturns or upturns accurately, but this isn’t the case. One common misconception is risking misinterpretation—believing a certain shape guarantees a specific outcome. The yield curve’s signals can be ambiguous, especially since data limitations affect its reliability. For example, short-term rates can be influenced by central bank policies, not just economic expectations. Likewise, external factors like market sentiment or global events can distort the curve’s signals. It’s important to remember that the yield curve is just one tool among many. Relying solely on it without considering broader economic indicators can lead you to false conclusions, potentially exposing you to unnecessary risk. Additionally, understanding the different cookie categories can help you interpret market data more effectively. For instance, electric bikes and other alternative transportation options have different impacts on economic activity and consumer behavior, which can influence market signals. Being aware of data limitations is crucial to avoid overestimating the predictive power of the yield curve. Recognizing the influence of central bank policies helps in understanding why the curve may not always reflect true economic fundamentals. Incorporating multiple economic indicators provides a more comprehensive and reliable analysis of market conditions. Always analyze multiple data points to form a clearer economic picture.

What Has Historically Happened When the Yield Curve Inverts?

When the yield curve inverts, it often signals that a recession may be on the horizon. Historically, this inversion has been a reliable predictor, but it also brings notable effects. Here’s what has happened in the past:

- Bond liquidity tends to decrease as investors rush for safer assets, making it harder to buy or sell bonds without affecting the price. This reduced liquidity can lead to increased volatility in bond markets.

- Currency fluctuations often intensify, as investors seek stability, impacting exchange rates and international trade.

- Economic activity slows down, and past inversions have often preceded periods of economic contraction, sometimes leading to tighter credit conditions.

- Changes in bond market conditions and other sensory cues can sometimes reflect underlying shifts in environmental or health factors, paralleling how economic signals can hint at broader systemic changes.

While not foolproof, these patterns highlight how an inverted yield curve can be a signal of upcoming economic shifts, affecting markets and global finance.

How Do Investors and Economists Use the Yield Curve in Practice?

Investors and economists rely on the yield curve as a vital tool to assess economic outlooks and shape investment strategies. By analyzing the shape and shifts of the yield curve, you can gauge potential risks and opportunities in the market. A normal or steepening curve may signal economic growth, guiding you to focus on riskier assets with higher returns. Conversely, an inverted curve can indicate upcoming downturns, prompting you to tighten risk assessment and prioritize safer investments. In portfolio management, the yield curve helps you adjust asset allocations, hedge against potential risks, and time entry or exit points. Overall, understanding the yield curve enables you to make informed decisions, manage risk effectively, and optimize your investment strategies in response to changing economic signals. Recognizing the importance of market signals can help you create a more resilient and adaptable investment plan. Additionally, interpreting the shape of the yield curve offers insights into future economic conditions, allowing you to plan more proactively in your investment approach. Being aware of economic indicators enhances your ability to interpret these signals accurately and refine your financial strategies.

Key Takeaways: How to Interpret the Yield Curve Without Being Misled

Interpreting the yield curve accurately requires understanding common pitfalls and distortions that can lead you astray. To avoid misreading signals, focus on these key points:

Interpreting the yield curve needs awareness of distortions and external influences for accurate signals.

- Watch for unusual bond spreads, which can distort the curve and mask true risk perceptions.

- Be cautious of inflated risk premiums, as they might reflect market stress rather than economic outlooks.

- Remember that a normal upward-sloping curve suggests healthy growth, while an inverted one signals caution, but always consider external factors like monetary policy or liquidity issues.

- Recognize that market perceptions of economic uncertainty can influence yield movements and should be factored into your interpretation.

Frequently Asked Questions

How Often Does the Yield Curve Change in Typical Market Conditions?

In typical market conditions, the yield curve can change weekly or even daily, especially during periods of market volatility. You’ll notice shifts driven by economic data, Federal Reserve policies, and investor sentiment, which influence bond yields. While historical patterns show the curve often remains stable over months, sudden market shifts can cause rapid changes. Staying alert to these fluctuations helps you better understand economic expectations and manage investment risks.

Can the Yield Curve Predict Specific Economic Events or Just General Trends?

Think of the yield curve as a weather forecast—helpful but not perfect. It mainly signals general economic trends, not specific events. While historical accuracy shows it’s a reliable indicator of economic shifts, its predictive limitations mean it can’t forecast precise outcomes. You shouldn’t rely solely on it for exact predictions, but it’s valuable for gauging the broader economic climate and preparing accordingly.

What Role Do Central Banks Play in Influencing the Yield Curve?

Central banks influence the yield curve mainly through monetary policy. When they raise or lower interest rates, it affects short-term yields directly, shaping the curve’s slope. You should also watch how their policy signals impact inflation expectations, which drive long-term yields. By adjusting rates and communicating economic outlooks, central banks can steer the yield curve, signaling their stance on economic growth and inflation to investors.

Are There Differences in Yield Curve Signals Across Different Countries?

Think of the yield curve as a global tapestry; international differences and currency impacts shape its patterns. You’ll notice signals vary across countries because each economy’s growth prospects, inflation expectations, and monetary policies differ. Currency fluctuations can amplify or dampen these signals, making the yield curve’s message more complex. So, don’t assume the same signals apply universally—pay attention to country-specific factors to interpret the yield curve accurately worldwide.

How Reliable Is the Yield Curve as a Standalone Indicator for Investing Decisions?

The yield curve can be a reliable indicator, but don’t rely on it alone. Its historical accuracy shows it often predicts recessions, yet market anomalies can cause false signals. You should combine the yield curve with other data—economic indicators, market trends, and global events—to improve your investing decisions. By doing so, you reduce risks tied to unexpected shifts and get a clearer picture of potential market movements.

Conclusion

Remember, the yield curve offers valuable insights, but it’s not a crystal ball. Sometimes, its signals align perfectly with market shifts, while other times, they mislead. Keep a keen eye on the shape and context, but don’t rely solely on it for predictions. Like a coin flip, it’s a reminder that market signals can be coincidental—so stay informed, cautious, and always consider the bigger picture.